China Evergrande Group EGRNF -6.10% last month missed a scheduled interest payment to overseas bondholders, raising the prospect that October could bring one of the largest defaults in years.

Investors have been grappling with unknowns including what the Chinese government might do in response. Beijing has signaled it is preparing to cushion the blow to national interests. That could include potential aid to Chinese investors, banks, Evergrande’s suppliers and home buyers who committed financially to homes that have yet to be completed.

Evergrande and the real-estate sector in general are important cogs in China’s economy, and the overheated housing market was already showing signs of a downturn. At the same time, few analysts expect good news for the foreign owners of the company’s dollar bonds.

Evergrande last month said it had hired financial advisers and has said that default was a risk.

China’s housing bubble

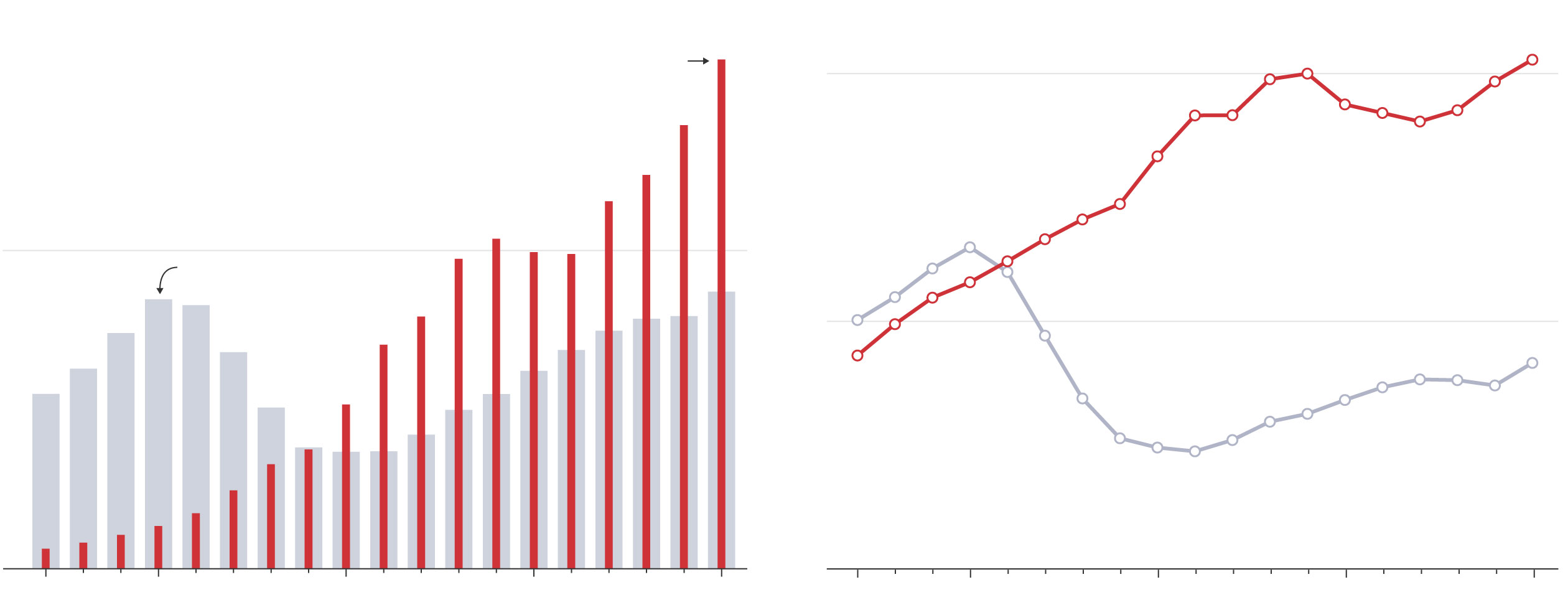

Analysts have generally indicated an Evergrande default wouldn’t spur a crisis of confidence like the one that followed the Lehman Brothers collapse. But Evergrande is the largest property developer in a Chinese real-estate bubble that has been expanding for years. Investment over the past decade in China’s residential-property market has dwarfed the U.S. housing bubble of the 2000s, at least in terms of its share of domestic economic output.

Investment in residential real estate, annual

China in 2020

$1.6 trillion

China

10%

of GDP

IN DOLLARS

PERCENTAGE OF GDP

$1 trillion

U.S. in 2005

$847 billion

Investment in residential real estate, annual

China in 2020

$1.6 trillion

China

10%

of GDP

IN DOLLARS

PERCENTAGE OF GDP

$1 trillion

U.S. in 2005

$847 billion

Investment in residential real estate, annual

China in 2020

$1.6 trillion

China

10%

of GDP

IN DOLLARS

PERCENTAGE

OF GDP

$1 trillion

U.S. in 2005

$847 billion

Investment in residential real estate, annual

China in 2020

$1.6 trillion

IN DOLLARS

PERCENTAGE

OF GDP

China

10%

of GDP

$1 trillion

U.S. in 2005

$847 billion

China in 2020

$1.6 trillion

Investment in residential real estate, annual

IN DOLLARS

$1 trillion

U.S. in 2005

$847 billion

PERCENTAGE OF GDP

China

10%

of GDP

China in 2020

$1.6 trillion

Investment

in residential

real estate, annual

IN DOLLARS

$1 trillion

U.S. in 2005

$847 billion

PERCENTAGE OF GDP

China

10%

of GDP

China in 2020

$1.6 trillion

Investment

in residential

real estate, annual

IN DOLLARS

$1 trillion

U.S. in 2005

$847 billion

PERCENTAGE OF GDP

China

10%

of GDP

Building boom

The scale of Evergrande’s ambitions was staggering. As of the end of last year, the property developer had more than 700 projects under construction, covering 132 million square meters of total floor area. For comparison, the total floor area of the Empire State Building is about 257,000 square meters.

The floor area in Evergrande’s projects under construction is roughly equivalent to 513 Empire State Buildings.

Note: Based on Evergrande’s 132 million square meters of gross floor area in projects under construction as of year-end 2020 and the Empire State Building’s floor area of 257,211 square meters

Sources: Evergrande; Empire State Realty Trust

The floor area in Evergrande’s projects under construction is roughly equivalent to 513 Empire State Buildings.

Note: Based on Evergrande’s 132 million square meters of gross floor area in projects under construction as of year-end 2020 and the Empire State Building’s floor area of 257,211 square meters

Sources: Evergrande; Empire State Realty Trust

The floor area in Evergrande’s projects under construction is roughly equivalent to 513 Empire State Buildings.

Note: Based on Evergrande’s 132 million square meters of gross floor area in projects under construction as of year-end 2020 and the Empire State Building’s floor area of 257,211 square meters

Sources: Evergrande; Empire State Realty Trust

The floor area in Evergrande’s projects under construction is roughly equivalent to 513 Empire State Buildings.

Note: Based on Evergrande’s 132 million square meters of gross floor area in projects under construction as of year-end 2020 and the Empire State Building’s floor area of 257,211 square meters

Sources: Evergrande; Empire State Realty Trust

The floor area in Evergrande’s projects under construction is roughly equivalent to 513 Empire State Buildings.

Note: Based on Evergrande’s 132 million square meters of gross floor area in projects under construction as of year-end 2020 and the Empire State Building’s floor area of 257,211 square meters

Sources: Evergrande; Empire State Realty Trust

An Evergrande housing development in Beijing. Over the past decade, investment in China’s residential-property market has dwarfed the U.S. housing bubble of the 2000s.

Photo: Associated Press

Part of the uncertainty around Evergrande’s struggles stems from its sales practices. Evergrande sold many homes before they were completed. As of the middle of this year, the company had presold roughly 1.4 million individual properties worth about $200 billion combined.

Soaring demand

Another sign of the scale of China’s housing boom: home price-to-income ratios in China’s big cities make New York, London and Paris look cheap.

Ratio of home prices-to-income, by city

San Francisco

8 times yearly income

San Francisco

8 times yearly income

San Francisco

8 times yearly income

San Francisco

8 times yearly income

San Francisco

8 times yearly income

Bills to pay

At the core of this crisis is Evergrande’s mountain of liabilities, which stood at roughly $304 billion as of the middle of this year. That included $89 billion in debt outstanding, 42% of which was due in less than a year.

The company’s borrowings include nearly $20 billion in dollar-denominated bonds. On Sept. 23, it failed to pay $83.5 million in interest on that offshore debt, leaving foreign investors to weigh their options for recourse. Evergrande has a 30-day grace period before its nonpayment constitutes a default on its bonds.

Evergrande’s $304 billion in liabilities

Debt

$88.5 billion

Payables

$147.2 billion

Other

$68.7 billion

Chinese yuan debt

$67.6 billion

Includes money owed to third parties

such as suppliers and contractors,

payroll and other payables

Includes

tax and other

liabilities

U.S. dollar debt

$20.0 billion

Hong Kong dollar debt: $1 billion

Debt

$88.5 billion

Payables

$147.2 billion

Other

$68.7 billion

Chinese yuan debt

$67.6 billion

Includes money owed to third parties

such as suppliers and contractors,

payroll and other payables

Includes

tax and other

liabilities

U.S. dollar debt

$20.0 billion

Hong Kong dollar debt: $1 billion

Debt

$88.5 billion

Payables

$147.2 billion

Other

$68.7 billion

Chinese yuan debt

$67.6 billion

Includes money owed to third parties

such as suppliers and contractors,

payroll and other payables

Includes

tax and other

liabilities

U.S. dollar debt

$20.0 billion

Hong Kong dollar debt: $1 billion

Payables

$147.2 billion

Other

$68.7 billion

Debt

$88.5 billion

Chinese

yuan debt

$67.6 billion

Includes money owed

to third parties such as

suppliers and contractors,

payroll and other payables

Includes

tax and

other

liabilities

U.S. dollar debt

$20.0 billion

Hong Kong dollar debt: $1 billion

Payables

$147.2 billion

Other

$68.7 billion

Debt

$88.5 billion

Chinese

yuan debt

$67.6 billion

Includes money

owed to third parties

such as suppliers and

contractors, payroll

and other payables

Includes

tax and

other

liabilities

U.S.

dollar debt

$20.0 billion

Hong Kong dollar debt: $1 billion

Evergrande said Wednesday it struck a deal with a Chinese state-owned enterprise to sell most of its stake in a commercial bank for $1.5 billion, a sign that the country’s authorities are trying to help the property developer manage its debt crisis.

Many analysts say an Evergrande default isn’t likely to spur a large-scale crisis of confidence.

Photo: Getty Images

SHARE YOUR THOUGHTS

How do you think a potential Evergrande default would affect the economy and markets in China and world-wide? Join the conversation below.

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8